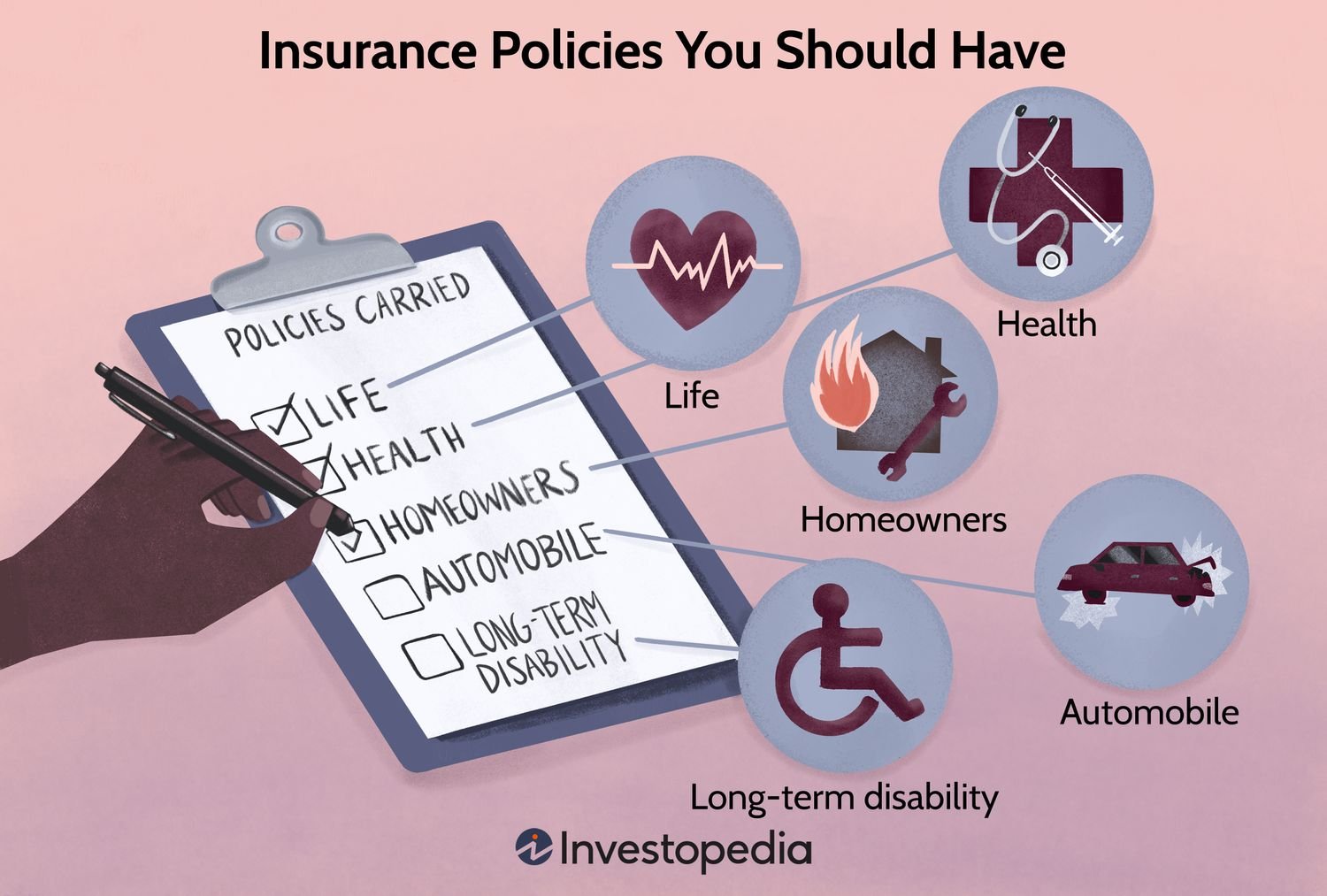

In today’s unpredictable world, having the right insurance coverage is essential for protecting your financial well-being and ensuring peace of mind. Here are five critical insurance policies that everyone should consider to safeguard against various risks.

1. Health Insurance

Overview: Health insurance is vital for covering medical expenses, which can be prohibitively expensive without coverage. It protects you from high out-of-pocket costs associated with hospital visits, surgeries, and routine care.Key Benefits:

- Covers a range of medical services, including preventive care, hospitalization, and prescription medications.

- Helps mitigate the financial burden of unexpected health issues.

- Essential for maintaining access to necessary healthcare services.

Consideration: Look for plans that cover essential health benefits as mandated by the Affordable Care Act, ensuring comprehensive coverage for various medical needs.

2. Auto Insurance

Overview: Auto insurance is not only a legal requirement in most states but also crucial for protecting you financially in the event of an accident.Key Benefits:

- Liability Coverage: Covers damages and injuries to others if you are at fault in an accident.

- Collision Coverage: Pays for repairs to your vehicle after a collision.

- Comprehensive Coverage: Protects against non-collision-related incidents like theft or natural disasters.

Tip: Regularly review your policy to ensure it meets your current needs and adjust coverage limits based on changes in your vehicle’s value or your circumstances 12.

3. Homeowners or Renters Insurance

Overview: Whether you own or rent your home, homeowners or renters insurance provides essential protection for your living space and personal belongings.Key Benefits:

- Property Coverage: Covers damage or loss of your home and personal belongings due to events like fire or theft.

- Liability Protection: Protects against claims of injury or damage occurring on your property.

- Additional Living Expenses: Covers costs of temporary housing if your home becomes uninhabitable due to a covered loss 15.

Consideration: If you rent, renters insurance is often affordable and can save you from significant financial loss in case of unexpected events.

4. Life Insurance

Overview: Life insurance is crucial for anyone with dependents. It provides financial support to loved ones in the event of your untimely death.Key Benefits:

- Can cover debts, funeral costs, and provide income replacement for dependents.

- Available in various forms, including term life (coverage for a specific period) and whole life (lifetime coverage with cash value accumulation).

Tip: Consult with a financial advisor to determine the appropriate coverage amount based on your family’s needs and financial obligations 24.

5. Umbrella Insurance

Overview: Umbrella insurance offers additional liability coverage beyond the limits of your home and auto policies. It acts as a safety net for significant claims that could otherwise deplete your savings.Key Benefits:

- Provides broader protection against claims not covered by other policies, such as defamation or false arrest.

- Higher coverage limits can protect substantial assets from lawsuits.

- Generally affordable compared to the amount of coverage provided 12.

Consideration: If you have significant assets or are at higher risk of being sued (e.g., owning rental properties), an umbrella policy can provide peace of mind.

Conclusion

Having these five types of insurance can significantly enhance your financial security and protect against unforeseen circumstances. Assessing your individual needs and consulting with insurance professionals can help you make informed decisions about the right policies for you.

Frequently Asked Questions (FAQ)

- Why is health insurance necessary?

- Health insurance protects against high medical costs and ensures access to necessary healthcare services.

- What does auto insurance cover?

- Auto insurance typically includes liability, collision, and comprehensive coverage to protect against various risks associated with driving.

- Is renters insurance worth it?

- Yes, renters insurance is affordable and provides crucial protection for personal belongings and liability coverage while renting a home.

- How much life insurance do I need?

- The amount depends on factors like income replacement needs, debts, and future expenses for dependents; consulting a financial advisor is recommended.

- What is umbrella insurance?

- Umbrella insurance provides additional liability coverage beyond standard home and auto policies, protecting against larger claims that could threaten your financial stability.