Understanding Insurance: A Comprehensive Guide

Insurance is a fundamental aspect of financial planning, providing protection against unexpected events that can lead to significant financial losses. This blog will explore what insurance is, how it works, the various types available, and why it is essential for individuals and businesses alike.

What Is Insurance?

Insurance is essentially a contract between an individual or business (the policyholder) and an insurance company. In this agreement, the insurer provides financial protection or reimbursement against specified losses in exchange for regular premium payments. By pooling the risks of many clients, insurance companies can offer coverage at more affordable rates.

Key Components of Insurance:

- Premium: The amount you pay for your insurance policy, typically on a monthly or annual basis.

- Deductible: The amount you must pay out-of-pocket before the insurance company covers the remaining costs.

- Policy Limit: The maximum amount the insurer will pay for a covered loss.

How Insurance Works

Insurance operates on the principle of risk management. When you purchase an insurance policy, you transfer the financial risk of certain events (like accidents, illnesses, or property damage) to the insurer. If a covered event occurs, the insurer compensates you according to the terms of your policy.

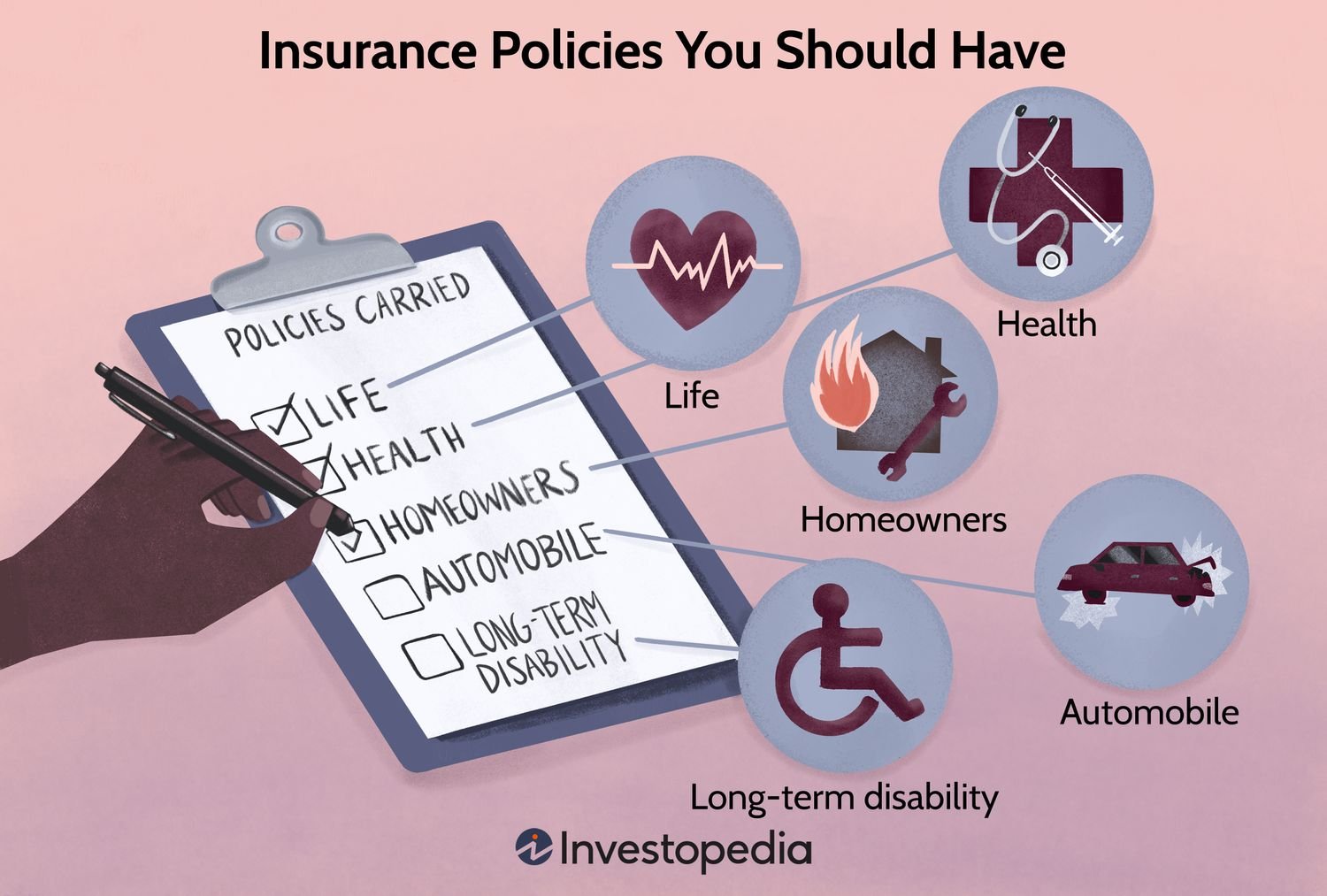

Most people have some form of insurance, including:

- Auto Insurance: Covers damages to your vehicle and liability for injuries or damage to others.

- Health Insurance: Helps cover medical expenses for routine and emergency care.

- Homeowners Insurance: Protects your home and belongings from various risks like theft or natural disasters.

- Life Insurance: Provides financial support to your beneficiaries in the event of your death.

Types of Insurance

There are numerous types of insurance policies available to cater to different needs:

- Health Insurance: Covers medical expenses and may include additional services like vision and dental care. Policies can vary significantly in terms of coverage levels and costs.

- Auto Insurance: Required by law in most places, it protects against damages resulting from car accidents and theft. Coverage options can include liability, collision, and comprehensive plans.

- Homeowners Insurance: Protects your home from risks such as fire, theft, and certain natural disasters. It also typically covers personal property within the home.

- Life Insurance: Offers a payout to beneficiaries upon the policyholder’s death. There are two main types: term life (coverage for a specific period) and whole life (coverage for life with a cash value component).

- Travel Insurance: Covers losses related to traveling, including trip cancellations, medical emergencies abroad, and lost luggage.

- Business Insurance: Tailored for businesses to protect against various risks such as property damage, liability claims, and employee-related issues.

Why Is Insurance Important?

Insurance plays a critical role in safeguarding your financial future by providing peace of mind against unforeseen events. Here are some reasons why having insurance is essential:

- Financial Protection: It helps cover significant expenses that could otherwise lead to financial hardship.

- Risk Management: By transferring risk to an insurer, individuals and businesses can operate with greater confidence.

- Legal Requirements: Certain types of insurance, like auto liability insurance, are mandated by law.

- Peace of Mind: Knowing that you have coverage in place can alleviate stress regarding potential financial losses.

Conclusion

Insurance is a vital component of personal finance that protects individuals and businesses from unexpected events that could lead to significant financial strain. By understanding the different types of insurance available and their key components—premiums, deductibles, and policy limits—you can make informed decisions about which policies best suit your needs. Whether it’s health insurance for medical expenses or auto insurance for vehicle protection, having the right coverage is essential for financial security and peace of mind.