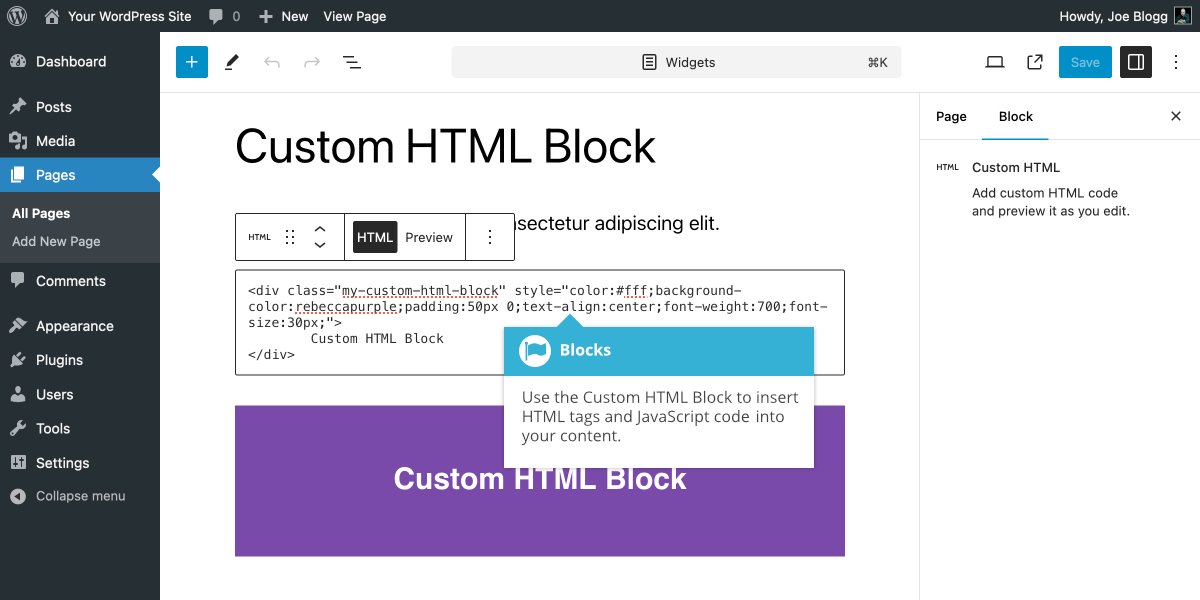

Starting an online store requires a platform that supports eCommerce features, enabling you to manage sales and transactions. Integrating a payment gateway is a vital part of this process, as it allows you to accept payments, automate purchases, reduce fraud risks, and meet industry standards. For those using WordPress, the WooCommerce plugin is an excellent choice, offering seamless integration with various payment gateways.

In this blog post, we’ll explore the best WooCommerce payment gateways in 2024. We’ll dive into their features, transaction models, fees, and other important factors to help you choose the right one for your business.

Top 8 WooCommerce Payment Gateways

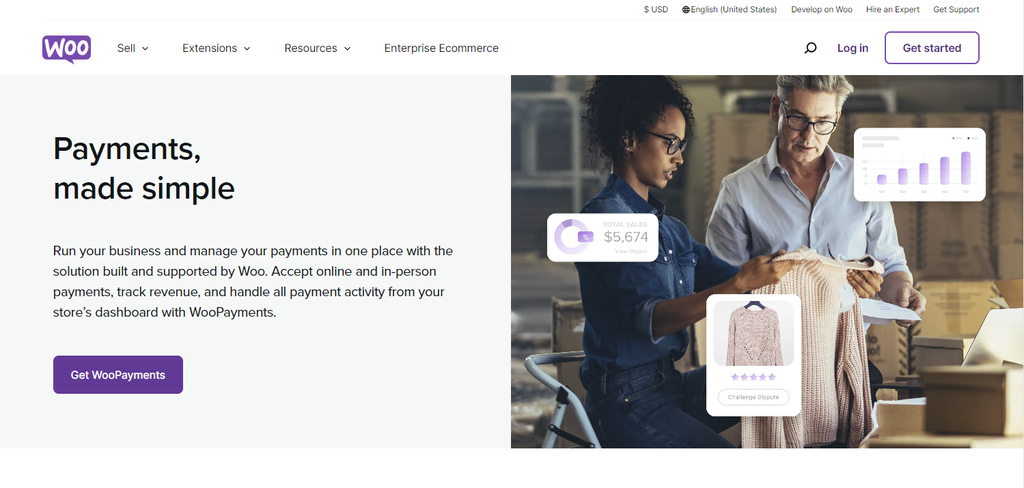

- WooCommerce Payments

- Transaction Fee: 2.90% + $0.30 per local transaction for US-issued cards.

- Supported Currencies: 135+ currencies.

- Supported Regions: 38 countries.

- Native integration with WooCommerce for seamless functionality.

- Custom deposit schedules and on-demand transfers.

- Supports Google Pay and Apple Pay.

- Not available in all regions, particularly in Africa and Asia.

- Lacks built-in support for recurring revenue models.

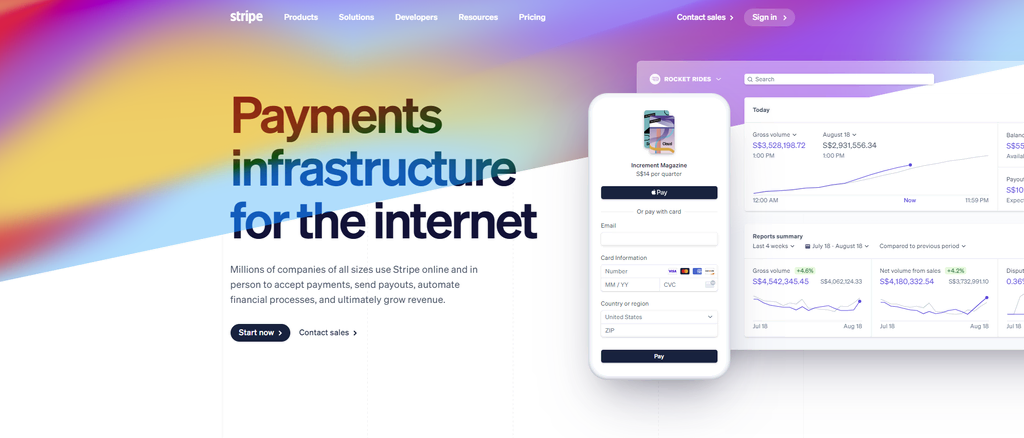

- Stripe

- Transaction Fee: 2.90% + $0.30 per card or digital wallet transaction.

- Supported Currencies: 135+ currencies.

- Supported Regions: 46 countries.

- Payment Links and one-click checkout.

- Advanced fraud protection with Stripe Radar.

- No setup fees, pay-as-you-go pricing.

- Requires some technical knowledge for configuration.

- Additional costs for extra services like custom domains.

- Square

- Transaction Fee: 2.90% + $0.30 per transaction.

- Supported Currencies: Based on supported countries.

- Supported Regions: US, Canada, Australia, UK, France, Spain.

- In-person and online payment processing.

- PCI compliance and secure payments.

- Virtual terminal for remote payments.

- Limited to certain countries.

- Additional monthly fees for certain business plans.

- Authorize.net

- Transaction Fee: 2.90% + $0.30 per transaction.

- Supported Currencies: 12 currencies.

- Supported Regions: US, Canada, UK, Europe, Australia.

- Advanced fraud detection suite.

- eCheck payments and recurring billing options.

- Customer Information Manager for storing payment and shipping details.

- Monthly gateway fees of $25.

- Limited international support.

- PayPal

- Transaction Fee: 2.99% + fixed fee per transaction.

- Supported Currencies: 25 currencies.

- Supported Regions: 200+ countries.

- Popular and trusted globally.

- PayPal.Me for easy payment requests.

- Seller protection against fraud and chargebacks.

- Extra fees for international transactions.

- Limited customization without coding knowledge.

- Amazon Pay

- Transaction Fee: 2.90% + $0.30 per domestic transaction.

- Supported Currencies: 80+ currencies.

- Supported Regions: 18 countries.

- Uses Amazon’s trusted checkout system for a smooth customer experience.

- Buy with Prime integration for faster purchases.

- A-to-Z Guarantee for fraud detection and chargeback protection.

- Customers need an Amazon account.

- Limited international availability.

- Apple Pay

- Transaction Fee: Free for domestic transactions.

- Supported Currencies: 80+ currencies.

- Supported Regions: 83 countries.

- Fast and secure payments with Apple devices.

- Tap to Pay and Apple Pay Later options.

- Multi-layered security including Face ID and tokenization.

- Limited to Apple users, not widely adopted by Android users.

- Smaller user base compared to other payment methods.

- Alipay

- Transaction Fee: 3% per card transaction.

- Supported Currencies: 27 currencies.

- Supported Regions: 110+ countries.

- QR code payment system, popular in China.

- Multiple transaction methods including bank transfers.

- User-Presented Mode Payment for slow internet scenarios.

- Not FDIC-insured, meaning funds are at risk if the platform fails.

- Primarily focused on China, with some features restricted internationally.

This video explains the best payments gateway for woocomerce

How to Pick the Best WooCommerce Payment Gateway

When selecting a payment gateway for your WooCommerce store, consider these factors:

1. Understand Your Target Market

Choose a gateway that supports the payment methods and currencies your customers prefer. If you have an international customer base, PayPal and Stripe may be ideal due to their global reach. For businesses in China, Alipay would be more beneficial.

2. Compare the Transaction Fees

Evaluate the fee structures of different payment gateways. For high-volume businesses, a lower transaction fee is crucial, while businesses with fewer transactions may benefit from gateways without monthly fees, such as Stripe and PayPal.

3. Ensure Security

Security should be a top priority. Look for gateways that are PCI-compliant and offer built-in fraud protection. Stripe and WooCommerce Payments both provide excellent security features to protect both merchants and customers.

4. Look for Additional Features

Consider extra features like recurring billing, mobile transaction support, and easy integration with your existing setup. Features like fraud protection, invoicing tools, and customer account management can greatly enhance your store’s functionality.

Conclusion

Choosing the right payment gateway is essential for the success of your WooCommerce store. Each payment gateway offers different features, transaction fees, and regional support, so the best option depends on your specific business needs. PayPal, Stripe, and Square stand out as top choices for global businesses, while WooCommerce Payments is a great native solution for those using the WooCommerce platform.

Consider your customer base, transaction volume, and the security features provided by each gateway to make the most informed decision. With the right payment gateway, you can streamline the checkout process, reduce cart abandonment, and provide a secure shopping experience for your customers in 2024.